|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

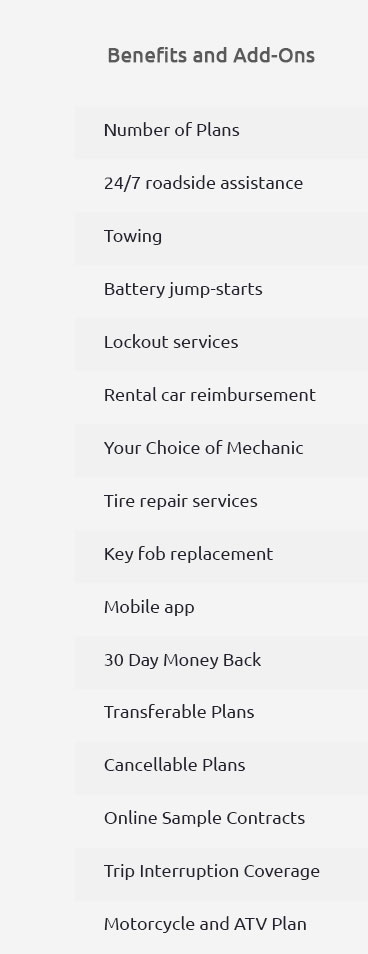

Automobile Coverage: A Comprehensive Guide for U.S. ConsumersWhen it comes to owning a car, automobile coverage plays a critical role in providing peace of mind and financial protection. In the United States, understanding the nuances of vehicle protection, repair costs, and extended auto warranties can save you from unexpected expenses. Let's explore the key elements of automobile coverage and how it can benefit you. The Basics of Automobile CoverageAutomobile coverage includes various forms of protection designed to cover repair costs, liability, and other potential expenses related to owning and operating a vehicle. It's essential to know what each type covers to make informed decisions. Types of Automobile Coverage

Exploring Extended Auto WarrantiesMany U.S. drivers opt for extended auto warranties to further safeguard against unexpected repair costs. These warranties can provide significant savings and peace of mind by covering repairs not included in the manufacturer's warranty. For example, the dodge extended warranty program offers coverage options tailored to keep your vehicle running smoothly. Benefits of Extended Warranties

Understanding Repair CostsRepair costs can vary widely based on the type of vehicle and the nature of the repair. Having a good insurance plan or warranty in place can significantly alleviate financial stress. Consider exploring car service plan insurance for additional protection options. Factors Influencing Repair Costs

FAQs

By understanding your options for automobile coverage, you can make more informed decisions that protect both your vehicle and your wallet. Whether you live in New York or California, exploring the right mix of insurance and extended warranties can lead to significant peace of mind and cost savings. https://www.statefarm.com/insurance/auto/coverage-options

With simple definitions for complicated insurance terms, State Farm is here to help you determine the right type of car insurance coverage. https://www.iii.org/article/what-covered-basic-auto-insurance-policy

What is covered by a basic auto insurance policy? - Bodily injury liability - Medical payments or personal injury protection (PIP) - Property damage liability. https://ldi.la.gov/docs/default-source/documents/publicaffairs/consumerpublications/consumer's-guide-to-auto-insurance.pdf?sfvrsn=c0907c52_71

2. What auto insurance do I have to buy? Liability coverage. 3. What about other coverage? Uninsured/underinsured motorist coverage. Uninsured ...

|